You have just begun working and are paying off student loans, moving out, buying your first car, and trying to keep it all together.

Yes, it is a tall ask, but PIAJ is suggesting that you start saving for retirement NOW!

You can only spare a $5,000.00 a month? Well, that is more than enough to get you started.

We would like to show you some scenarios that were modelled by our in-house actuarial consultant.

Each presents a real-world scenario of what a monthly $5,000.00 contribution to a pension plan can yield for you.

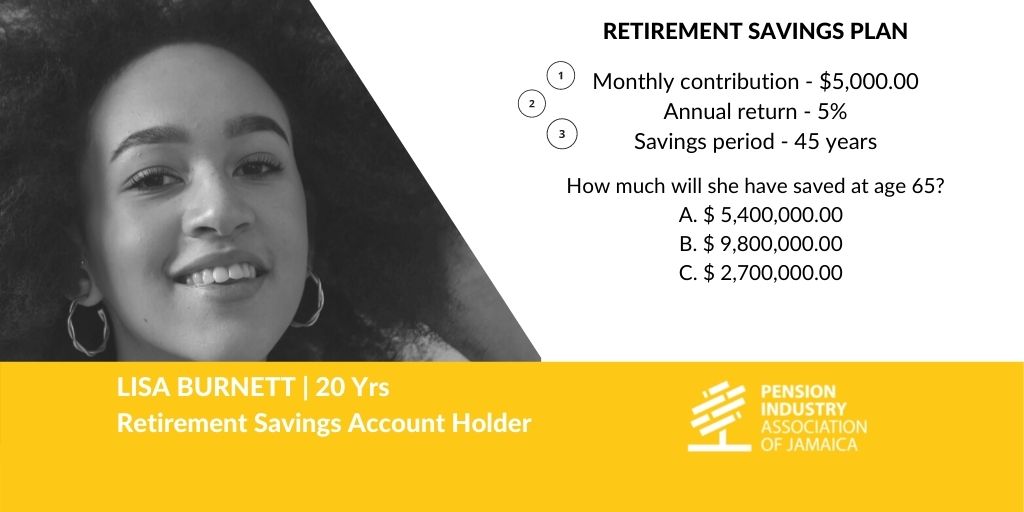

Wise Retirement Saver 1

Meet Lisa. Three months ago, she got her first job at WeServe BPO. She celebrated her 20th birthday by opening an Individual Retirement Account at her favourite bank and is saving $5,000.00 a month. By 65 she’ll have $9,800,000 tucked away to help her through her retirement years.

Wise Retirement Saver 2

Meet Traci. She’s passed the bar, nabbed dream job. She has big plans. Her SLB repayments are heavy, but she’s intent on saving for retirement from day one. Traci knows that it’s all worthwhile as she’ll have $23,700,000 saved for retirement when she hits 65.

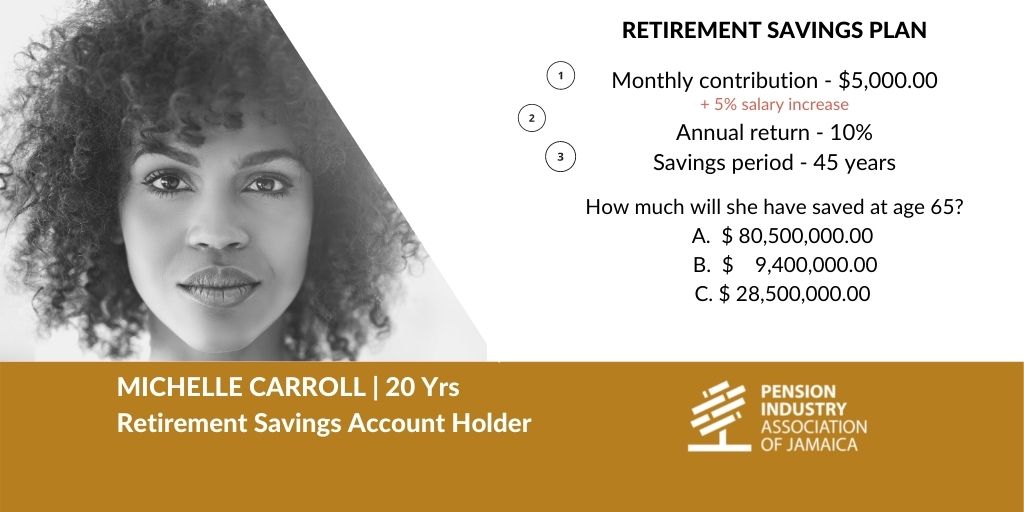

Wise Retirement Saver 3

Meet Michelle. She’s committed to saving her spare $5,000.00 a month and gradually increasing this amount so that she can begin her #dreamretirement right on time. Michelle smiles broadly when she thinks of the fun she’ll have turning her retirement dreams into reality. After all, her planning would have provided her with $80,500,000.00 for that next step in her journey.

We don’t just want you to meet our savings superstars. We want you to model their retirement planning approach now that we’ve shown you what $5000.00 can do.